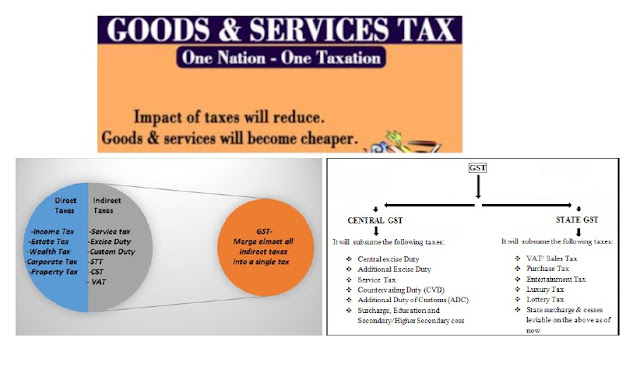

GOOD AND SERVICES TAX (GST)

Goods and Services Tax Bill or GST Bill

which is officially known as The Constitution (122 Amendment) Bill, 2014 is set

to become operational from the 1st April 2017.

This bill is widely hailed as a historical tax reform , as it

is expected to transform India into a unitary market, lower transaction and

logistics costs, spread the tax net wider and propel investments and

growth.

As of now, Indirect Taxes suffer from

multiple taxations on different rates by different States with increased

cascading effect of tax on the cost of goods and services due to ‘Tax on Tax’

and worst the ‘Tax Terrorisms’ on the economy - manufacturers, traders and even

consumers. GST is addressing these problems by

amalgamating several Central and State taxes into a single tax thereby

mitigating cascading or double taxation. And this will aim at ‘One Nation – One

Taxation’ which will go a long way in making India a most favoured nation for

investments thereby India becoming a Developed Nation sooner than expected.

From the consumer point of view, the biggest

advantage would be in terms of a reduction in the overall tax burden on goods,

which is currently estimated at 25% - 30%, free movement of goods from one

state to another without stopping at state borders for hours for payment of

state tax or entry and reduction in paperwork to a large extent.

There will be revenue losses to some

states with the introduction of GST, but, the Central Government has proposed

to insulate the revenue losses incurred by them from the date of introduction

of GST for a period of five years. Another major problem for the new GST

Council proposed to be set up under the Bill would be to decide on the

applicable tax rate. In order to protect the revenues of both the Centre and

the States, applicable tax rate should be fixed on the basis of revenue neutral

rate (RNR). But, it is felt that fixing a ceiling on revenue-neutral rate - at

18% as recommended by the Congress is self-defeating, if the same is included

in the Constituent Amendment Bill. If

that is done, in the event that the rate needs to be changed, the Central

Government has to adopt the whole constitutional amendment procedure and the

RNR will be got into this rigid procedure for something as simple as the rate,

which should be easier to change. Jaitley

rightly ruled out including GST rate in constitution bill saying that tariffs

cannot be cast in stone.

Why do we need GST? - can be briefly

explained.

Here A sells goods to B who in turn sells

to C and C is loading all sales taxes of A and B apart from his own sales tax

on the head of the ultimate consumer and this cascading effect becomes a tax on

tax. But GST with its Dual GST Model, this tax on tax is removed. Under Dual

GST Model, there are only three types of taxes to be levied on each kind of

transaction.

1.SGST – State GST, collected by the

State Govt.

2.CGST – Central GST, collected by the

Central Govt.

3.IGST – Integrated GST, collected by the

Central Govt.

Now let us see how GST operates

and how these State and Central taxes are applied?

Case 1: Sale in one state, resale in the same

state:

It is a sale within a State - from Mumbai

to Pune, CGST and SGST will be levied and the collection goes to the Central

Government and the State Government as indicated below. Then the goods are

resold from Pune to Nagpur, this again a sale within a state, so CGST and SGST

levied.

Case 2: Sale in one state, resale in

another state:

Goods are moving from Indore to Bhopal -

it is a sale within a state - CGST & SGST levied. Collected taxes go to

State and Central Governments.

Goods are resold from Bhopal to Lucknow -

it is outside state - IGST levied. Collected tax goes to Central

Government. Note that both the input

taxes are taken as credit. Note that SGST never went to the Central Government,

still the credit is claimed. This is the crux of GST. Since this amounts to a

loss to the Central Government, the state government compensates the central

government by transferring the credit to the central government.

Case 3: Sale outside the state, resale in

that state:

Goods moving from Delhi to Jaipur

(outside the state) and then goods are resold from Jaipur to Jodhpur (within

the state).

Outside the state: Being interstate sale,

IGST alone levied. Collection goes to Central Government.

Within state sale: CGST and SGST levied.

Note: Against CGST and SGST, 50% of the

IGST, that is Rs.8 is taken as a credit. But wee that IGST never went to the

state Government, still the credit is claimed against SGST. Since this amounts

to a loss to the State Government, the Central Government compensates the state

government by transferring the credit to the State Government.

Some More ADVANTAGES OF GST

Apart from full allowance of credit,

there are several other advantages of introducing a GST in India:

•Possible reduction in prices

•Increase in Government Revenues

•Less compliance and procedural cost

One Major advantage of GST is that it

will reduce tax evasion. All traders will insist on taking bills for all their

purchases, as it gives them a better profit margin. This is explained here with

an example. See

the display on the left.

Suppose you are a mobile phone

distributor. You are buying mobile phones from the manufacturer and selling to

wholesaler.

The net position after introduction of GST is

detailed in the display in the chart below:

As we can see, in GST scenario, net

profit for the distributor with invoice is Rs.5000/- whereas without invoice

his net profit is only Rs.4000/-. Now, if the customer himself insists on

taking the bill, we can assume that tax evasion will fall. This is the biggest

advantage of GST.

Even after the introduction of GST,

petroleum shall continue as it is, because GST on petroleum products has been

deferred as per the latest bill. Even Import Customs Duty is exempt from

GST.

In short, the introduction of goods and

services tax will lead to the abolition of taxes such as octroi,

Central sales tax, State level sales tax, entry tax, stamp duty, telecom

licence fees, turnover tax, tax on consumption or sale of electricity, taxes on

transportation of goods and services, and eliminate the cascading effects of

multiple layers of taxation. It will boost up economic unification of India; it

will assist in better conformity and revenue resilience; it will evade the

cascading effect in Indirect tax regime.

Conclusion

A Well designed GST will lower the tax

rate by broadening the tax base and minimizing exemptions. It will foster a

common market across the country and reduce compliance costs. It will

facilitate investment decisions being made on purely economic concerns,

independent of tax considerations. It will promote exports. GST will also

promote employment. Most importantly, This results in better administration of

tax.

Comments