NIRMALA’S ‘NEW INDIA’ BUDGET 2019 - 20

Finance Minister Nirmala Sitharaman was the second woman finance

minister to present the budget 2019-20 on July 5 – first woman being Indira Gandhi in 1970 as a Prime Minister holding Finance portfolio. It took Nirmala 2 hours and 15 minutes and

interestingly, while reading out the budget, she did not pause even to have a

glass of water.

Nirmala had also broken the conventions

followed by her predecessors on two counts.

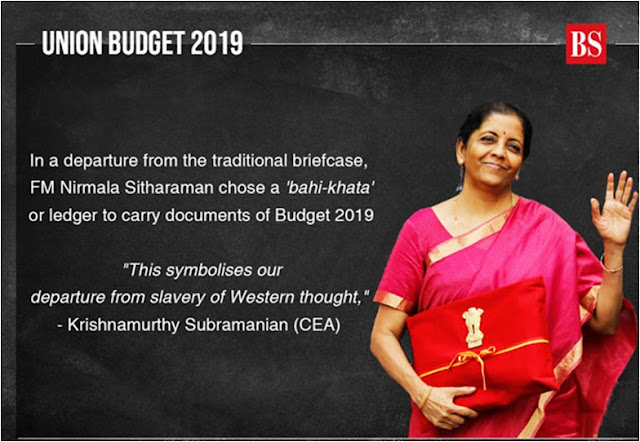

•Conventional Leather Brief Case to

carry the budget papers – Colonial British Custom was given up by Nirmala with a bright red cloth bag with a

small national emblem of India in golden metal at the centre beautifully tied

around by a golden thread to carry the budget papers to the parliament house.

•

•Reading the allocations to different

ministries or the macro economic numbers like projected revenues or expenditure

was skipped by saying that these are very much available in the annexure of the

budget documents.

•

It is a different story if P Chidambaram had mocked Nirmala by commenting that next time,

Congress will come with iPad instead of Budget Papers!

Though some remarked that Nirmala’s budget was simply “Play Safe – Please All” type. But if the budget could pass the test of ‘Please All’, it can be taken as a win win situation to Nirmala.

As it was first budget after Modi’s second term with massive victory in

Lok Sabha, this first Budget had laid the foundation stone for a long term vision to

attain the goal of a New India with a $5 Trillion Economy by 2024 – i.e. within 5 years.

In this context Nirmala said: “Our economy was at about $1.85 trillion when we formed the government in 2014. In 5 years it has reached $2.7 trillion. At the end of the financial year, Indian economy will be nearing $3 trillion.” When one is reminded about the fact that it has taken more than 55 years for the Indian economy to reach $1 trillion, the achievements of Modi Government’s last 5 years rule could be really gauged and applauded.

The Hindu News Paper had, to our surprise, reported the budget proposals in

a very balanced manner. Actually, it had praised the Budget by and large. The

Hindu remarked that the budget sought to tackle several pain points in the

economy through incremental steps rather than opting for the spectacular

announcement route.

It was a credit given by the Hindu to Nirmala for tackling several pain points in

the economy. The inadequacy theory put forth by the Hindu through its statement

–“Incremental steps rather than opting for the spectacular announcement route” – had lost its sheen, as the Hindu in the next paragraph itself had stated

these:

•One of the biggest announcements the

Finance Minister made was of a £70,000/- crore capital infusion in public sector banks to be used as growth capital now

that the legacy issues plaguing the sector have been addressed.

•

•Finance minister also announced a

slew of measures to ease the liquidity and regulatory problems affecting the

NBFC sector, a key pain point in India’s economy at the moment.

•

•Budget incorporated a number of

positive tax reforms such as lowering the corporate tax rate for companies with

an annual turnover of less than £400 crore and increasing the surcharge to be

paid by high net worth individuals earning more than £2 crore a year. It also finally provided relief for startups from the undue pain

of the angel tax.

Even the observation of the Hindu in its editorial column as under can also

be taken as a half hearted appreciation for Nirmala for keeping the fiscal deficit at

3.3%:

“There were expectations of a big growth push through either tax cuts or

large expenditure programmes even if it meant a rise in the

fiscal deficit. But the Finance Minister has chosen to be fiscally

conservative, opting to play the long term game, though it could lead to pain

in the short term.”

But many economics pundits had lauded Nirmala to keep fiscal deficit under

control.

Due to honest tax payers, Direct tax revenue – increased by over 78% to £11.37 lac crores in the last 5 years.

It would be increasing its external borrowing programme since India’s external debt to GDP was below 5% and among the lowest globally.

Other Important Features of the Budget in a nutshell:

•GST on electric vehicles cut to 5% -

Additional income tax deduction of £1.5 lac on interest on loans taken to buy

electric vehicles.

•Threshhold for applicability of lower

corporate tax rate of 25% increased from £250 crore to £400 crore.

•Pension benefit extended to 3 crore retail traders.

•60% of the amount received by

subscribers of National Pension System on closure of account to be exempt from

income tax.

•Expansion of women SHG interest

subvention programme to all districts.

• £1 lac loan under MUDRA

scheme for one woman in every SHG

•8 crore more free LPG

connections to be given under Ujjwala yojana

•Labour laws to be

rationalized into four labour codes.

•100% FDI to be permitted for insurance intermediaries.

•Local sourcing norms to be eased for

FDI in single brand retail.

•To expand Swachh Bharat Mission to undertake solid waste management in all villages.

•£70,000 crore fresh re-capitalisation for Public Sector Banks.

•RBI to be the regulatory authority

for the housing finance sector.

•RBI has only limited regulatory

authority over NBFCs and hence steps to be taken now to strengthen the RBI and

housing finance companies will also be regulated by the RBI.

•If the RBI is satisfied that in the

public interest or to prevent the affairs of an NBFC being conducted in a

manner detrimental to the interest of the depositors or creditors, it can

supersede the board for upto five years.

•FM Zero Budget Farming – to maintain adequate number of livestock to the maximum possible number of

years – no fertilizer or pesticide – to make self sufficient green

villages.

•Budget is Green – due to its emphasise on clean energy – tax relief on electronic vehicles and reneweable energy.

•By 2024 every rural house to get

water through the Jal Jeevan Mission.

•Excise duty on fuel hiked by £1.

•TDS of 2% imposed on cash

withdrawals exceeding rs.1 crore in a year from bank accounts to

discourage business payments in cash.

In the interim budget of Piysh Goyal presented in the 16th Lok Sabha a few months ago which was termed as ‘Full Term Budget – Election Budget with popular Schemes’, Nirmala did not disturb those popular

schemes and tax benefits announced therein, but she had aimed at Long Term

Vision so that New India will become a reality at the end of 2024.

Increased Customs duty on gold and other precious metals from 10% to 12.5%

and Taxing the Super Rich with hike in surcharge on taxable income from £2 crore to £5 crore by 3%, £5 crore and above by 7% could not be criticized even by Congress because such criticisms will boomerang because of Rahul’s oft repeated comments of ‘Modi Charkar is Suit-Boot Charkar’.

Sufficient allocation of funds for further free LPG gas connections,

Housing For All, Rural Tap Water Connections to all households under Jal Jeevan Mission are to be welcomed and appreciated as these are all people

oriented programmes.

If Government does not perform,

Anti-Incumbency factor will set in. But Modi’s last 5 year rule had not affected

by such negative sentiments, but, voters had voted Modi Again due to pro-incumbency mood.

The major threatening issue may be unemployment and these should be tackled

with full force by more and more developmental activities – both Government and Private.

People are looking with confidence that Modi will deliver what He had promised.

This budget might not have scored 100% mark, but it had definitely scored A if not A+ as being assessed by us.

Purananooru Tamil Poem Quoted by Nirmala

in her Maiden Budget 2019

As Finance Minister Nirmala Sitharaman introduced Part B of her budget speech — dealing with

taxation — she lightened the mood by quoting a proverb in Tamil from the Purananuru anthology of Sangam literature. She narrated the poem in Tamil first

before explaining its meaning in English.

“Just a few mounds of rice from

paddy that is harvested from a small piece of land would be sufficient for the

elephant. But what if the elephant itself walks into the field to eat? It would

eat much lesser than it would trample with its foot.”

The Purananuru is a collection of

400 poems composed by multiple ancient Tamil poets. The original poem,

translated from Tamil, is a piece of advice directed at Paandiyan Arivudaiyanambi, a Pandyan King mentioned in Purananooru 184. The poem dates between the first century BC to the

third century AD.

The poet’s name is Pichiranthaiyar.

The full poem, available in Love Stands Alone: Selections from Tamil Sangam Poetry goes:

If an

elephant is fed with rice

harvested from the fields,

even a small strip of land

will feed him for days.

But when the elephant enters the fields to forage,

more rice is trampled upon than eaten.

Acres of land lie ravaged.

Likewise, when a wise king

collects his taxes methodically,

his coffers will be full

and the country will prosper.

But when a weak king

and his ignorant, ostentatious officers

harass the people for taxes

his kingdom will be like the fields

tramped by the elephant.

He gets nothing

and his country, too, will suffer.

harvested from the fields,

even a small strip of land

will feed him for days.

But when the elephant enters the fields to forage,

more rice is trampled upon than eaten.

Acres of land lie ravaged.

Likewise, when a wise king

collects his taxes methodically,

his coffers will be full

and the country will prosper.

But when a weak king

and his ignorant, ostentatious officers

harass the people for taxes

his kingdom will be like the fields

tramped by the elephant.

He gets nothing

and his country, too, will suffer.

The Finance Minister

added that the advice given to Paandiyan Arivudaiyanambi is "valuable advice

that this government appreciates. An elephant if it is given mounds of rice,

here I refer to taxation, will be quite happy. It doesn't have to enter the

field to trample. So we don't intend to trample anybody."

Comments