GOOD AND SERVICES TAX (GST)

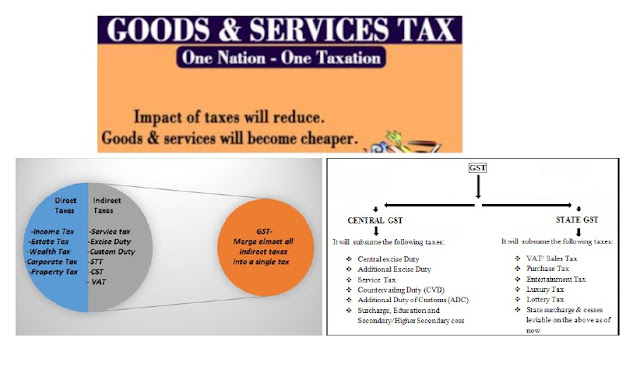

Goods and Services Tax Bill or GST Bill which is officially known as The Constitution (122 Amendment) Bill, 2014 is set to become operational from the 1st April 2017. This bill is widely hailed as a historical tax reform , as it is expected to transform India into a unitary market, lower transaction and logistics costs, spread the tax net wider and propel investments and growth. As of now, Indirect Taxes suffer from multiple taxations on different rates by different States with increased cascading effect of tax on the cost of goods and services due to ‘Tax on Tax’ and worst the ‘Tax Terrorisms’ on the economy - manufacturers, traders and even consumers. GST is addressing these problems by amalgamating several Central and State taxes into a single tax thereby mitigating cascading or double taxation. And this will aim at ‘One Nation – One Taxation’ which will go a long way in making India a most favoured nation for investments thereby India becoming a Developed Nati...