Union Budget 2018 – Ballot & Lotus Focused

Budget had focused on the distressed sections of the economy – mainly

farmers, informal workers and the rural sector thereby a pro-farm budget. As

Agriculture was the distressed section for quite long time, the present budget

had concentrated on long term and sustained measures instead of free-bees like

farm loan waivers which are poor substitute for lasting solution, but, vote

catch mechanism.

Arun Jaitley, the

Finance Minister, in his 105-minute budget speech at the Parliament House while

presenting his budget, used the words like ‘agri’ in 38 times, ‘farm’ in 39 times and

‘rural’ in 35 times. That is enough to call this budget as ‘Pro-Farm’.

Staying true to government’s electoral promise of doubling farmers’ income

by 2022, the minimum support price – MSP – of kharif crops and all rabi crops was fixed at 1 ½ times the production cost of the crops.

•Linking Gramin Agricultural Markets (GrAMs) to the electronic National

Agriculture Market (e-NAM) network

• Agri-Market Infrastructure Fund to set

up for developing agricultural markets

•Operation Greens to be launched on

the lines of ‘Operation Flood’

•Launching of a restructured National

Bamboo Mission to give a boost to bamboo cultivation by calling bamboo as

‘green gold’

- are some of the measures to cheer

the farm and rural sectors.

Rs.10,000 crore infra development fund for fisheries, aquaculture and animal husbandry was

also to help the allied farm sectors.

Next big

ticket measure was explained by the Finance Minister thus: “From ease of doing

business, our government has moved to ease of living for the poor and middle

class.”

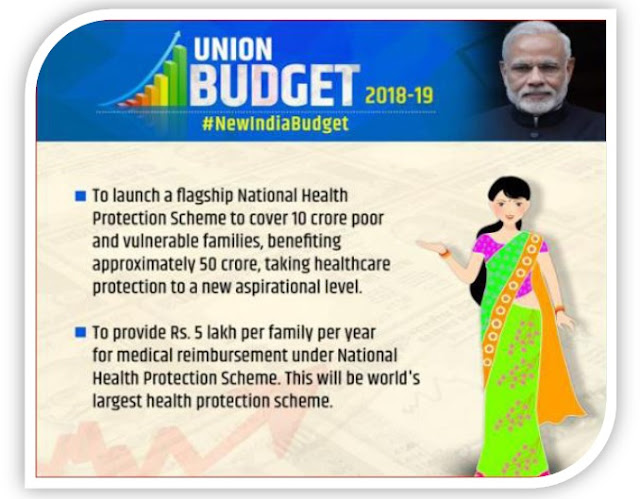

Ayushman Bharat’ has been achieved by

his unveiling of ambitious plan to

launch the world’s largest government funded health care programme providing insurance cover up to Rs.5 lacs per family annually to take care of secondary and tertiary care

hospitalization costs benefiting around 50 crore people from poor and vulnerable

families. This will almost cover 40% of the Indian population.

Housing for All by 2022 Scheme, Furthering target of Free LPG connections

to 8 crore poor women under the Ujjwala Scheme, 2 crore more toilets under Swachh Bharat mission, and a whopping Rs.16,000 crore allocation for the Saubhagya Yojana to provide electricity connection

free of charges to 4 crore poor households were all in the

budget.

This budget has reduced corporate tax to companies who have turnover up to

rs.250 crore in the financial year 2016-17 and hence such Micro, Small and Medium

Enterprises (MSMEs) are expected to invest the funds freed up by this lower

corporate taxes thereby improving the job market. This is said to cover 99%

companies and hence this measure is expected to create jobs.

And 100% tax deduction for first five years to companies

registered as farmer producer companies with a turnover of Rs 100 crore and above may

also attract investment in this segment and this may also add to job market.

Senior citizens are being

blessed with more benefits by increasing the exemption limit for interest

income on deposit, raising the deduction for health insurance premium and/or

medical expenditure and increased deduction for expenditure on critical illness.

As there was no change in

the income tax slab, honest salaried income tax paying people were disappointed

– their only solace being the benefit of a flat Rs.40,000/- deduction from

taxable income in lieu of the existing tax exemptions for transport and medical

allowance thereby denying full benefit of Rs.40,000/- to salaried persons. But,

pensioners who are also eligible for this standard deduction will get full

benefit.

Imposition of increased 4% education

and healthcare cess will also reduce

the income tax benefit for salaried class.

An ambitious plan for Indian

Railways with a focus on modifications and safety rather than new train lines,

24 new Government Medical Colleges and Hospitals, Special ‘Ekalavya’ schools at par with Navodaya Vidyalas only to cater to scheduled tribes areas particularly in

North-East Indian Border States are all other areas of improvement and

development.

The Hindu which is usually anti-Modi in its portrayals

and outlooks, had all praises for this budget and it is really unbelievable

that the Hindu seems to give a good credit to the overall budget proposals. The

Hindu prefers to call this budget as ‘Famer Sutra’, ‘a mix of populism and prudence’.

There were no major criticisms about the budget in the Hindu so far.

G. Sampath, Social Affairs Editor of the Hindu, wrote an article

titled ‘Pakodas

in the snow’ in

the Hindu dated 04-02-2018 wherein he said: ‘This is a bold, historic, and

common man-friendly budget that deserves 10/10.’

E-Touch is still in dilemma whether Sampath means and stands by

what he wrote or is it a simple April Fool syndrome?

Modi had done so far many good things for India and one

should not forget that Modi took charge only

about 4 years back. What Congress could not do during its long rule of about 65

years – with many stalwart leaders at

the centre, Modi had done wonderfully

well to make India Great – Developed – Admired by all – here and abroad –

people as well as world leaders.

THINK INDIA THINK AND ACT TO ELECT

MODI AGAIN.

Cartoon in the Hindu dated 02-02-2018

Comments