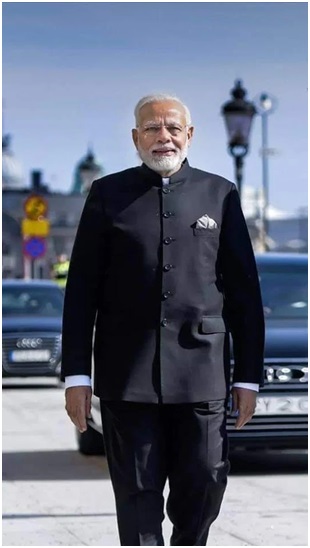

INTERIM Budget 2019 – Innovative Visionary Budget with Missionary Zeal

Piyush Goyal, Interim Finance Minister, though

said to present an Interim Budget, had given a deadly shock just like ‘Economic Surgical Strike’ to all opposition

parties making them utterly confused ‘how to react and oppose the Budget of Modi?’.

Because the benefits were extended to almost all sections of the societies

like farmers having cultivable land up to 5 acres of land – with £ 6,000 per year as support cash

incentives to buy agricultural inputs such as fertilizers, seeds, etc.,

unorganized informal sector workers drawing a monthly salary of £ 15,000/- with

pension of £ 3000/- per month from the age of 60 years just paying an amount

ranging from £ 55/- to £ 100/- each month depending upon their age at the time

of joining the scheme, and above all, the honest taxpaying middle class earning

up to £ 5 lacs removed completely from tax liabilities and with full use of £ 1.5 lac exemption available under Section 80C of the Income Tax Act even those

earning annual income of £ 6.5 lacs need to pay no tax, had estopped all opposition party members.

If other exemptions announced in the Budget are taken into account, no tax

need to be paid upto £ 10 lacs approximately.

These benefits cover more than 12 crores farmers, 30-40 crores workers employed in the unorganized sector and around 3 crore middle class families.

Goyal had in his budget

speech acknowledged the contributions made by the middle class tax payers and

thanked them. This is the first time such encomiums were showered on the honest

middle class tax payers.

Goyal had further

confirmed that his Government had taken every steps to see that their tax money

was spent judiciously, honestly and wisely and that adequate steps had been

taken to remove middle men so that full benefits reached the targeted groups

with the introduction Direct Benefit Scheme using Digital India platform and

bank accounts with aadhar numbers to plug any

lapses and leakages.

As a tribute to Salaried Persons, they are also given further following

benefits in the people’s friendly budget:

•Standard deduction raised to £ 50,000/- from £ 40,000/- which will give additional tax benefit of £ 4700/-.

•Tax Deduction at Source (TDS) on

interest earned on bank/post office deposits raised from £ 10000/- to £ 40,000/-.

•TDS of tax on rent increased from £ 180000/- to £ 240000/-.

•No Notional rent for 2 houses – relief being provided considering the difficulty of the middle class

having to maintain families at two different locations on account of their

jobs, children’s education, or the care of parents.

Honesty of middle class people is trusted, as last year 99.54% of the

returns filed were accepted as they were filed. Budget promised that All income

tax returns will be processed in 24 hours and refunds issued simultaneously and

within the next 2 years, almost all verification and assessment of returns will

be done electronically thereby completely eliminating any personal interface

between taxpayers and tax officers.

Several incentives for home buyers, owners and real estate developers were

announced to give a boost to the real estate sector such as one in life time

capital gains under Section 54 of the Income Tax Act from investment in one

residential house to two for a tax payer with capital gains upto £ 2 crore, no payment of notional rent by builders for 2 years as it was estimated

that there are about 6.7 lac units lying unsold.

For

Capital market, stamp duty will be levied on 1 instrument relating to I

transaction that will be collected at stock exchange and then shared with the

particular State based on the buyer’s domicile and such a step will not

only help in simplicity of compliance but also in bringing down the overall

transaction cost.

For Defence and Home ministries, allocations

were around £ 3 lac crore and £ 1 lac crore respectively – an increase of 8% and 5% respectively in view of the border security and

internal law and order problem by equipping them with uptodate defence equipments and modernization of

police forces.

Similarly Railways get around £ 1.59 lac crore – the highest ever allocation.

Similarly, Micro, Small and Medium Enterprises (MSMEs) sector had got a 2%

interest subvention for loans up to £ 1 crore and to help the sector to market

their products, government had to buy at least 25% from MSMEs with a sub-clause

of procurement of 3% from women run organization under Government e Market (GeM).

The allotment of £ 750 crore to the Rashtriya Gokul Mission (RGM) is to develop Gokul Gram care centres for indigenous breeds of high

genetic merit with the objective to get native breeds to produce more milk and

to raise the quality of Indian cows and bulls to eventually outdo Jerseys and

Holsteins.

This budget should be specially appreciated for recognizing and

acknowledging the voiceless and very hard working unorganized sector employees.

They will be paid a monthly pension of £ 3000/- from the age of 60 years. It

is heartening to know this pension scheme to them, as their contributions in

building bridges, highways, railways, buildings, dams, railways etc. are the

backbone of all Governmental Developments. Though no one had ever demanded to

help such hard working employees, Modi Government had extended a helping

hand to such poor employees. The same spirit of humanitarian was extended to

nomadic communities by setting up a welfare development Board to help such most

deprived citizens.

Artificial

Intelligence being an important component of cyber physical system is now tied

to an existing programme called the National Mission on Interdisciplinary

Cyber-Physical Systems (NMICPS) having a total outlay of £ 3660/- crore for 5

years with an additional amount of £ 5 crore in the budget. It is expected to

create 40000 jobs in the short term and about 2 lacs in the long term.

Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax

Act, Fugitive Economic Offenders Act and Demonetization had compelled holders

of large cash currency to disclose their source of earnings. Due to these

measures, undisclosed income of about £ 1.3 lac crore apart from attachment of assets

worth about £ 50,000/- crore was achieved. Further benami assets worth £ 6,900 crore and foreign assets worth £ 1600 crore were attached. In all, 3.38 lac shell companies were detected and

de-registered and their directors disqualified.

Main objection raised by Rahul about this budget was that ‘I think it is an insult to the Indian farmer to turn around and tell him

that you are going to give him £ 17 a day; there could not have been

bigger insult than this.’

First of all the 6000/- annual amount payment is not for farmer’s daily maintenance and it is for agricultural inputs spread over to 3

seasons with the disbursement of £ 2000/- each which he can use it.

Further every amount of money has value. The assurance of something certain

coming to you gives a sense of confidence. Each family unit – of a married couple and their minor children – was eligible for the scheme. A household of 5 adult brothers jointly

owning a 10 hectare piece of land would receive £ 30,000 for the year. Farmers

holding cultivable lands upto 5 acres should not be portrayed as beggars – as if they had to depend completely

for their livelihood on freebees. But it is a fact that similar schemes in Teleganga and Odisha are paying more – and hence under Federal set up, it is upto State Governments to supplement the

Central Government assistance.

The Hindu Newspaper had headlined the budget as “SOP

OPERA” and in its editorial “Shopping for votes”, but strangely the contents

and tenor were not in tune with the sarcastic headlines and editorial contents.

Even the Hindu had published next to its Editorial an article written by by Ashima Goyal - a member of the

Prime Minister’s Economic Advisory Council under the heading ‘Distributing the

rewards of reform’.

The Hindu in its editorial had observed: ‘Though some

past governments have announced sops in their interim budgets with an eye on

elections, this budget has gone much further announcing very significant

measures. In political terms, the strategy cannot be faulted as it appears to

have put the opposition in a difficult spot – protesting too much about the

concessions given to those in distress may be counter-productive. That said,

some of these ideas may actually work in economic terms as they put money in

people’s hands.’

The important part of this budget was that it had spelt

out Vision 2030 for New India. Perhaps the goal is based on the Sustainable

Development Goals (SDGs) or 17 Global Goals set by the United Nations General

Assembly in 2015. The budget had listed 10 items with an ambitious goal to make

India a Developed Nation.

1.Infrastructure: To

build physical and social infrastructure for a “ten trillion dollar economy” in

the next 8 years and to provide ease of living.

2.Digital India - digital Infrastructure and digital

economy will be built upon the successes achieved in recent years in digitisation of Government

processes and private transactions.

3.Clean and green India - Besides making India a pollution

free nation, the government plans to drive the electric vehicle revolution.

4.Rural industrialization - To develop grass-roots level clusters, structures and

mechanisms encompassing the MSMEs, village industries and start-ups spread

across India.

5.Clean rivers - safe drinking water to all Indians,

sustaining and nourishing life and efficient use of water in irrigation using

micro-irrigation techniques.

6)Oceans and coastline - To tap into the ‘Blue Economy’ by

scaling up the Sagarmala project to develop

other inland waterways faster.

7)Space - Our space programme -- Gaganyaan, India becoming the launch-pad of satellites for the

World and placing an Indian astronaut into space by 2022.

8)Self-sufficiency in food production - To achieve

self-sufficiency in food in an organic way through modern agricultural

practices and value addition.

9)Health - To create a healthy society with an environment

of health assurance and the support of health infrastructure aiming to work

towards a distress free health care and a functional, and comprehensive

wellness system.

10)Minimum government, maximum governance - To have a

proactive and responsible bureaucracy which will be seen as friendly by the

people by 2030.

Goyal had said: In short, with this

comprehensive ten-dimensional Vision, we will create an India where poverty,

malnutrition, littering and illiteracy would be a matter of the past. India

would be a modern, technology-driven, high growth, equitable and transparent

society.

This

budget, as explained by an article in Economic Times, makes an effort to

balance the short – to medium-term objectives of the economy with a long-term

vision for 2030.

Hence

we have termed this Budget as a visionary one with setting clear goals which Modi

Government’s Team India is confident to achieve in record time with missionary

zeal.

Modi Development Agenda coupled with 10% reservation for

Economically Weaker Section in General Category plus people’s friendly

incentive oriented Budget especially No Tax upto 5 lacs for salaried employees, annual support income of £

6000/- to farmers and pension of £ 3000 for unorganized sector workers etc. are

enough to win 2019 Lok Sabha election with

thumbing majority.

Modi’s move to Supreme Court which is not serious to hasten

the process of hearing the Ram Janma Bhoomi Land dispute Case,

had filed an affidavit to hand over the undisputed land surrounding the

disputed site to the rightful owners and VHP declaring that this is a right

move by Modi Government and they

will not do anything to disturb the present status till the Lok Sabha election and also

urging all to vote for Modi Government – are all

good tidings and signs for Modi to Win 2019 with thumping majority – more than what Modi had achieved in 2014

Lok Sabha election.

Bharath Mathaki Jai! Vanthe Matharam

Comments